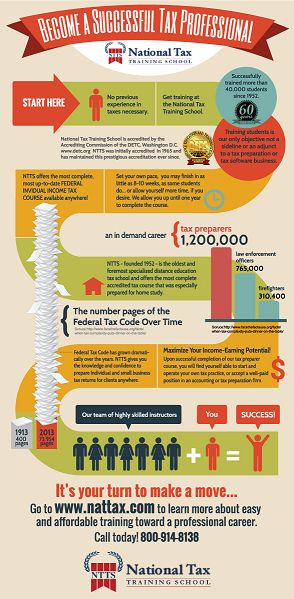

Our nationally accredited tax courses provide the proper training you need to succeed as a tax professional.

Accredited Tax Preparation Course in federal tax law and procedures. Trains you to prepare income tax returns for individuals and small businesses.

Whether you are looking to supplement an existing income or begin a new career entirely, becoming a tax preparer may be the perfect solution for you!

Enroll Now! You set your own pace … So you may finish in as little as 6 to 8 weeks.

No previous experience in tax preparation necessary!

Find out the specifics of what you’ll learn in the tax course.

Learn about our training materials.

See the tax course reviews and statistics.

Higher Course in Federal Taxes

Advanced Tax Training Course – for graduates of the NTTS Federal Income Tax Course, as well for others with previous tax training or experience.

A comprehensive advanced training program, covering tax planning and tax preparation for high-income individuals, partnerships and corporations. An excellent course for those looking to take IRS Special Enrollment Examination. IRS approved for continuing education requirements for Enrolled Agents.

Course curriculum: learn tax preparation for individuals and corporations

Learn about the enrolled agent exam